Solutions

Customer Support

Resources

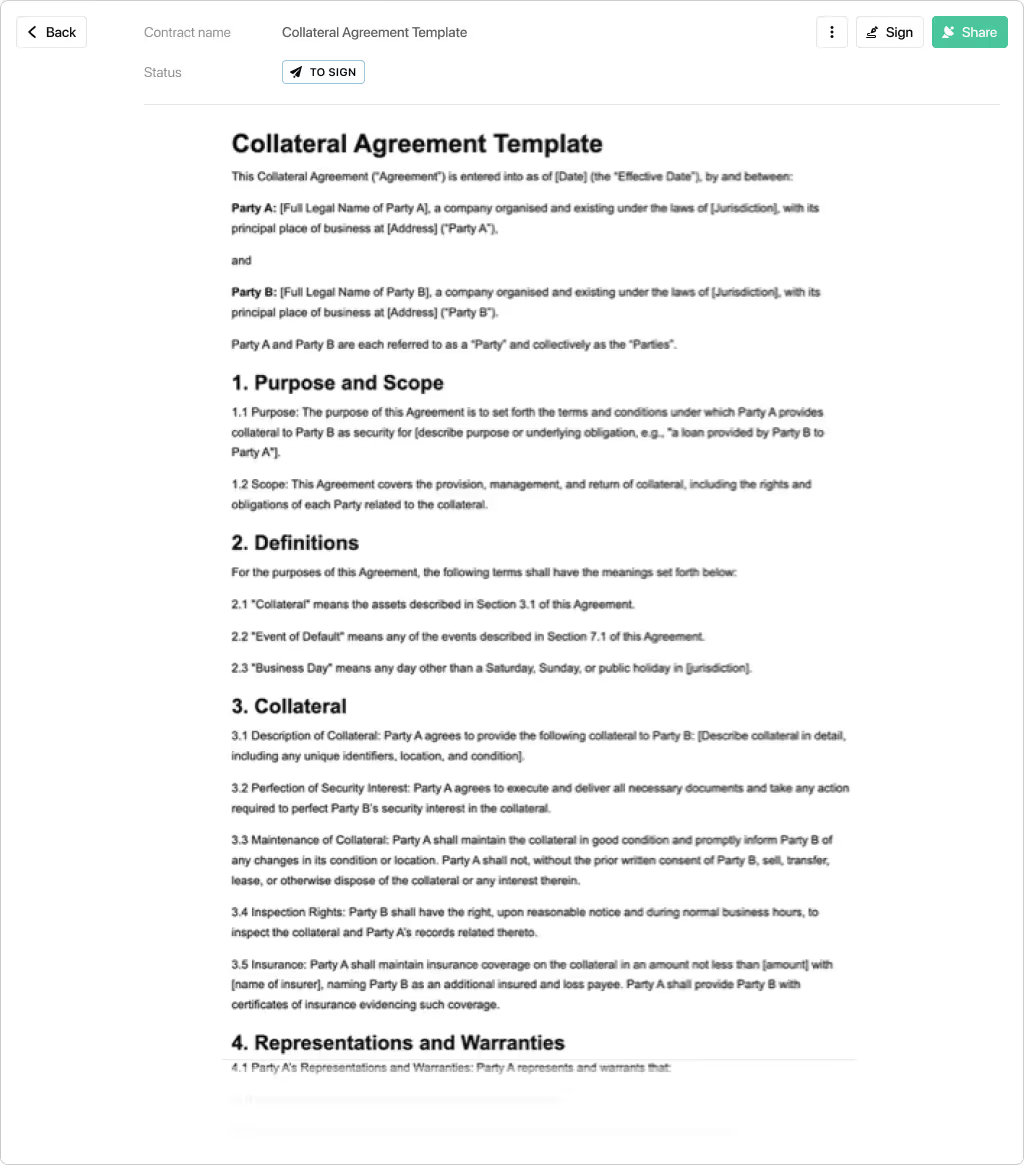

Secure loans with a collateral agreement template, outlining assets used as security and loan repayment conditions.

Collateral agreements are essential in securing obligations and reducing risks for lenders. In this guide, we’ll explore what collateral agreements are, their purpose and what should be included in an effective template. We’ll also cover how contract management software like Juro can streamline the process, reduce errors and ensure compliance.

A collateral agreement is a legal contract where one party (the borrower) provides an asset to the other party (the lender) as security for a loan or other obligation. The collateral can be various assets, including real estate, inventory or intellectual property. This agreement ensures that if the borrower defaults on their obligation, the lender can seize the collateral to recover their loss.

A collateral agreement is a secondary contract that supplements and supports a primary agreement. Its main purpose is to provide additional assurance or security to the obligations outlined in the primary agreement. Here are the key purposes of a collateral agreement:

Collateral agreements are typically managed by various parties involved in the contractual relationship. The specific management responsibilities can depend on the nature and context of the agreement. Here are the key parties who commonly manage collateral agreements:

When a collateral agreement is used to secure a loan, the lender or financial institution often oversees the management of the collateral. This includes monitoring the value of the collateral, ensuring its proper documentation, and taking action if the borrower defaults.

Legal and compliance teams within an organization are responsible for drafting, reviewing and ensuring compliance with the collateral agreement. They ensure that the terms are legally sound and that the organization adheres to all relevant regulations.

In larger organizations, dedicated contract managers or administrators may be responsible for managing collateral agreements. Their duties include tracking obligations, deadlines and conditions related to the collateral.

The party providing the collateral also has responsibilities – which include maintaining the value and condition of the collateral and ensuring that it remains unencumbered (free of other claims).

Sometimes, third-party service providers specializing in collateral management are hired to handle the administrative and operational aspects of managing collateral. These services can include valuation, custody and reporting.

In certain agreements, an independent trustee or escrow agent may be appointed to hold and manage the collateral on behalf of the parties involved, ensuring that all conditions are met before releasing the collateral.

Collateral agreements are used in several situations to provide security and assurance for various types of obligations. Common scenarios include:

When a borrower takes out a loan, the lender may require collateral to secure the loan. If the borrower defaults, the lender can claim the collateral to recover the loan amount.

In mergers, acquisitions, or large business deals, collateral agreements can be used to ensure that payment or performance obligations are met.

When purchasing property, buyers often provide collateral to secure mortgage loans. The property itself typically serves as the collateral.

In construction or service contracts, collateral agreements can ensure that the contractor or service provider completes the project as agreed.

Landlords may require tenants to provide collateral – such as a security deposit – to cover potential damages or unpaid rent.

Businesses may use collateral agreements to secure payment for goods or services provided, reducing the risk of non-payment.

In some legal disputes, collateral agreements may be used to ensure compliance with settlement terms, such as payment of damages or performance of specific actions.

Collateral agreements provide a safety net for one party, ensuring that obligations are fulfilled and reducing the risk of loss.

A collateral agreement should include several key elements to ensure clarity, enforceability and protection for all parties involved. Here are the essential components:

Parties involved: Clearly identify all parties to the agreement, including their legal names and contact information.

Description of collateral: Provide a detailed description of the collateral being used, including any identifying details such as serial numbers, legal descriptions or other unique identifiers.

Obligations secured: Specify the primary obligations that the collateral secures, such as a loan, performance of services or payment of debts.

Terms and conditions: Outline the specific terms and conditions under which the collateral will be held, including any requirements for maintaining its value or condition.

Default provisions: Define what constitutes a default under the agreement and the steps that will be taken if a default occurs, such as the process for seizing and selling the collateral.

Rights and responsibilities: State clearly the rights and responsibilities of each party, including any maintenance or insurance requirements for the collateral.

Valuation: Detail how the collateral will be valued and any requirements for periodic revaluation.

Release of collateral: Specify the conditions under which the collateral will be released back to the provider, such as upon full repayment of a loan or completion of contractual obligations.

Governing law: Indicate which jurisdiction’s laws will govern the agreement and how disputes will be resolved.

Signatures: Ensure the agreement is signed by all parties, including any witnesses or notaries if required by law.

Managing collateral agreements manually involves several key steps, each requiring meticulous attention to detail to ensure compliance and accuracy. Here’s a step-by-step breakdown of the process:

1. Contract initiation and creation

2. Review and negotiation

3. Approval

4. Execution

5. Implementation

6. Monitoring and compliance

7. Renewal and amendments

8. Archiving

This manual process, while thorough, is time-consuming and prone to human error. Each step requires careful coordination and communication to ensure that the collateral agreement is managed effectively. Data entry mistakes and miscommunication can lead to missed deadlines and compliance issues. And document management is cumbersome and prone to loss and damage, making retrieval difficult and inefficient.

Fortunately, these challenges can be resolved through a robust contract management tool like Juro.

Juro provides an AI-powered platform that makes managing collateral agreements faster and more efficient. By automating tasks like drafting and approvals, Juro saves time and reduces delays. Multiple stakeholders can collaborate in real-time within a single workspace, which streamlines communication.

Juro automates repetitive tasks involved in the creation and management of contracts by providing automated contract templates and workflows. By reducing the manual effort required, legal and business teams can focus on more strategic activities, accelerating every stage of the contract lifecycle.

Our software fosters seamless collaboration across teams within a single, browser-native workspace. This eliminates the need for multiple platforms and reduces the chances of miscommunication or lost documents. Teams can negotiate, edit and approve contracts in real-time, ensuring faster turnaround times.

Juro enables business teams to self-serve on contracts without leaving the tools they work from already, like CRMs and project management tools. This reduces the dependency on legal teams to draft, review and progress contracts since commercial teams can take the lead with minimal risk.

Storing collateral agreements in a data-rich contract repository provides unparalleled insight into contract performance and risks. The centralized system makes it easy to search for and retrieve contracts, monitor compliance and analyze contract data to inform business decisions.

Juro’s platform offers robust tracking and analytics features, giving teams visibility into the status of each contract at any stage. This transparency helps in identifying bottlenecks and resolving issues swiftly, further speeding up the contract management process.

Juro's AI-native contract automation platform empowers all teams to create, agree, execute and manage contracts up to 10x faster than traditional tools. To find out more, hit the button below to book your personalized demo.

Juro is the #1-rated contract platform globally for speed of implementation.