Solutions

Customer Support

Resources

Insurance contract management is the collection of processes used by insurance companies to manage the legal agreements within their businesses.

It can cover everything from property insurance agreements to health or automobile insurance, or the wide range of business insurance contracts agreed between organisations today.

Insurance premiums written in the US alone are worth more than $1 trillion dollars annually. The insurance ecosystem would collapse without robust contracting underpinning it, and it’s important to make sure processes work for both the insured and the insurer to leave no doubt as to each party’s rights and responsibilities.

Insurance is all about managing risk. After all, you buy insurance to protect you in case something bad happens. But without watertight legal documentation, and robust processes in place to handle it, is that risk really managed?

Gaps in your insurance contract management process can result in coverage being incomplete, or both parties being misaligned on what’s covered and what’s not. To feel confident that the risk element is under control, effective contract management is essential.

Gaps in coverage, for either the insurer or the insured, can have serious consequences. If insurance contracts reach the end of their effective date without one of the parties realising, then coverage could be interrupted, leaving the insured party vulnerable.

Alternatively, the insurance contract might auto-renew, when in fact one of the parties didn’t want to begin a new period of coverage. This could lead to incurring costs you didn’t mean to, or renewing a commercial relationship you actually wanted to terminate.

Either way, unpredictable coverage is a serious problem in insurance and should be avoided wherever possible.

If your company’s growth relies on you agreeing new insurance contracts to generate revenue, then disjointed or manual contract processes can easily slow you down.

Getting deals over the line shouldn’t be a hostage to clunky eSignature-to-email workflows and lengthy negotiations over email. Instead, frictionless contract workflows should be a help, not a hindrance, when it comes to winning new business for your insurance company.

Legacy processes in insurance contract management can make it difficult to have transparency in your contract workflow. Too often, key stakeholders in businesses agreeing contracts at scale find themselves asking:

If your insurance contract management processes are ineffective, these common problems can recur and compound, causing pain and revenue risk for your business.

Bouncing draft agreements back and forth over email or messaging platforms, without a single source of truth, can become way too time-consuming.

It can be frustrating, or even distressing, for parties to an insurance contract to experience this kind of delay, as it might leave them without coverage and vulnerable in the event of something unfortunate happening that exposes them to risk or loss.

Alongside the delay involved if contracts are managed poorly, it provides a bad customer experience too.

If the insured party has a hard time navigating your contract process just to become a customer, it likely doesn’t give them confidence that the insurer will deliver quickly and decisively in the event of a claim being made.

The contract is a key customer interaction that sets the tone for the rest of your relationship. It’s important to make it as pain-free as possible to set you both up for success.

Juro lets you manage and visualize all your contracts and related actions from one easy-to-use contract dashboard, with a Kanban board to track contracts’ process through the lifecycle.

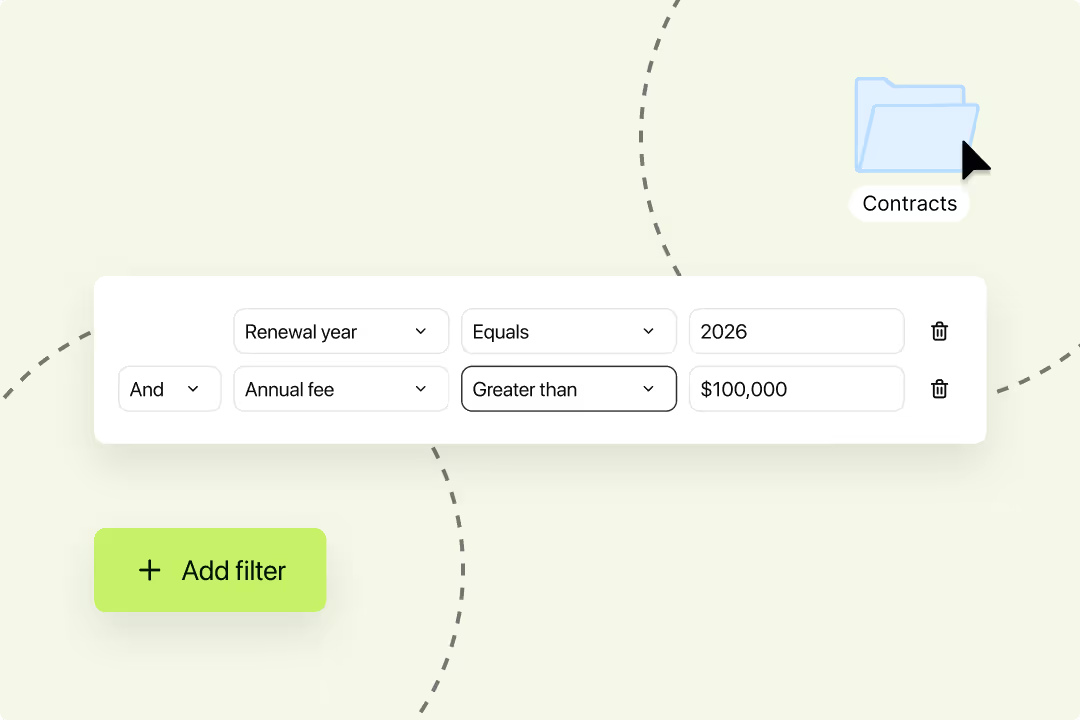

Users can even build customised table views that collect all contracts with a particular characteristic. This makes it quick and easy for users in the insurance sector to group their documents and track those elements most important to them.

If you manage insurance contracts with Juro, you can set up automated email reminders for key dates, like renewals or changes in coverage. This means no more missed deadlines, no more gaps in coverage, and no more hunting through PDFs to work out which contracts are expiring when.

With a tool like Juro in place you can let automation do the heavy lifting when it comes to tracking dates, and concentrate on high-value work that helps grow your insurance business.

Insurance contracts are too important to be scattered across multiple systems that vary in their locations, access controls and level of security.

Instead of a messy mix of online and offline storage systems, manage these critical legal documents in one robust platform with powerful encryption, enterprise-grade data security and advanced electronic signatures as standard.

Find out more about Juro’s lawyer-grade security in our trust centre.

Collaborating with colleagues on insurance contracts doesn’t have to be difficult. Instead of emailing around drafts and getting lost in version control, in Juro you can use comments and tagging - just like in Google Docs - to collaborate with colleagues on the contents of your contracts.

Similarly, negotiating with counterparties doesn’t need to be a drawn-out match of email tennis. Instead, counterparties can redline in the digital document, then commit and send their changes to you in one set of amends for you to consider.

You can then resolve these at your convenience, or better yet, use Juro’s latest generative AI to update the contract’s language for you.

While insurance contracts can have common elements, they can also vary greatly depending on the value or type of assets being insured. And as a consequence of this, the route they might need to take in the business (in terms of approvers, collaborators or signatories) might also need to to vary.

With Juro, you can build rules and conditions into your contract templates so that the clause language used, as well as the approval workflow, changes based on values you define.

This might mean, for example, that a contract where the assets covered are worth more than $100,000 needs to be approved by a more senior member of the team.

Juro is a Leader in contract lifecycle management (CLM), according to independent user reviews on G2. It has the highest adoption rate of any CLM platform, with a go-live time significantly below the category average, and the best support of any provider.

Read more about how customers rate Juro on G2 here.

Customers like Marshmallow choose Juro for insurance contract management software due to its:

To join the 6000+ companies in 85+ countries already using Juro to upgrade and accelerate their contracting processes, fill in the form below.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.