Solutions

Customer Support

Resources

Payment terms, billing cycles, renewal dates, discounts, liabilities: they’re all locked inside documents scattered across inboxes, drives and disconnected tools.

The result is familiar to every finance leader: inaccurate forecasts, surprise renewals, uncontrolled spend, and endless hours spent chasing information the business should already have.

This is the gap modern CLMs aim to close — but many still fall short for finance. Too many are built for legal workflows or simple document storage, not for delivering clean, structured, real-time contract data.

This guide breaks down what finance teams should prioritise in a CLM, which features actually matter, how to evaluate vendors through a financial lens to find the best tool for your team.

Finance teams typically evaluate CLM on five criteria:

Most legacy CLMs fail on the first two because they store static PDFs rather than structured data, making it impossible to enforce commercial guardrails or give finance teams reliable, real-time visibility into contract terms.

Juro is different. It is one of the few modern CLMs built on structured data, not document storage — and that’s why so many finance teams choose it.

If you’re done guessing and ready for real visibility into your contracts, book a demo or read on to find the right CLM for your team.

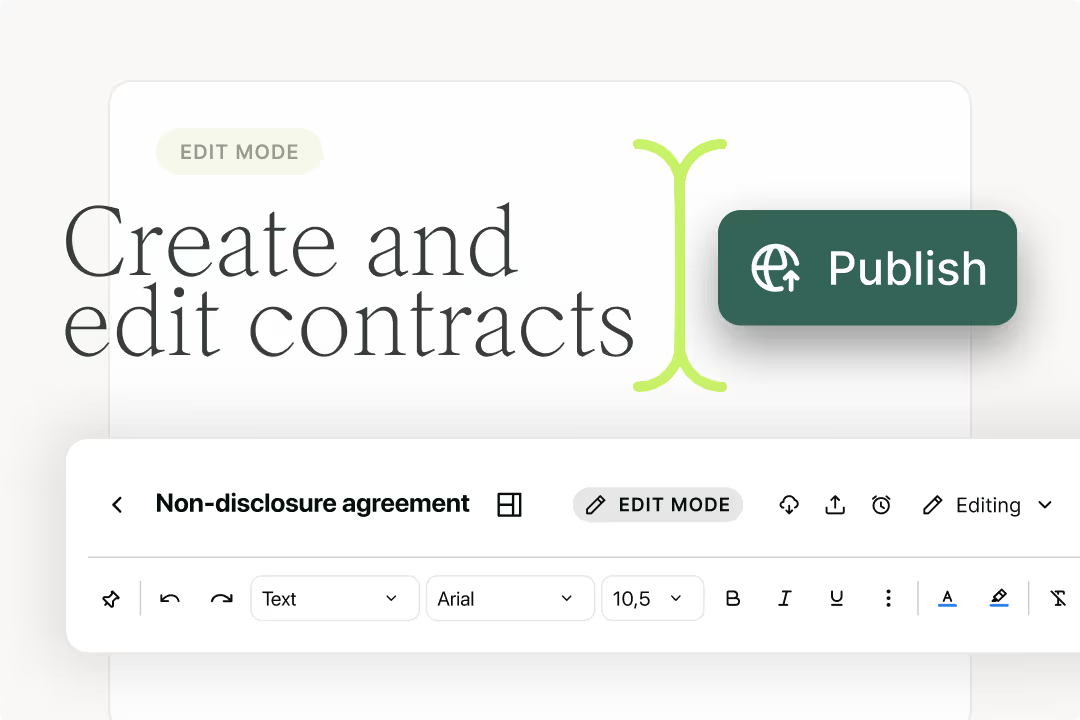

Every contract begins as a template. If the template produces inconsistent terms, unclear billing cycles or variable pricing, finance ends up dealing with the consequences.

Automated templates standardize payment terms, discounts and renewal logic, ensuring every contract captures clean, structured data at creation so finance can forecast accurately without manual checks.

They can define (and then lock in):

{{quote4}}

Finance teams care deeply about deviations: non-standard discounts, extended payment terms, custom billing, one-off concessions. They all come at a cost.

The best CLMs for finance teams should catch every outlier automatically.

In Juro, conditional logic functionality means:

As teams grow, manual oversight stops working. But workflow-based controls keep commercial terms aligned with the financial model at scale.

During the EOQ crunch, CFOs and COOs often block deals simply because they’re stuck manually signing dozens of low-risk agreements — a needless bottleneck and a disproportionate drain on senior time.

Bulk actions fix this instantly, allowing leaders to review once and sign everything in one click so contracts progress without delay and teams aren’t stuck waiting for signatures at the busiest moment of the quarter.

{{quote1}}

Missed renewals are expensive — whether it’s a vendor quietly rolling into another term or a customer churning because nobody followed up in time.

Automated contract reminders solve for this by giving finance and ops teams advance notice of every renewal, expiry, payment deadline or termination window, so nothing slips through the cracks.

For finance teams, this means tighter control over vendor spend, clearer visibility into churn risks and far more predictable cash-flow planning. It also eliminates the problem of unwanted auto-renewals entirely.

{{quote2}}

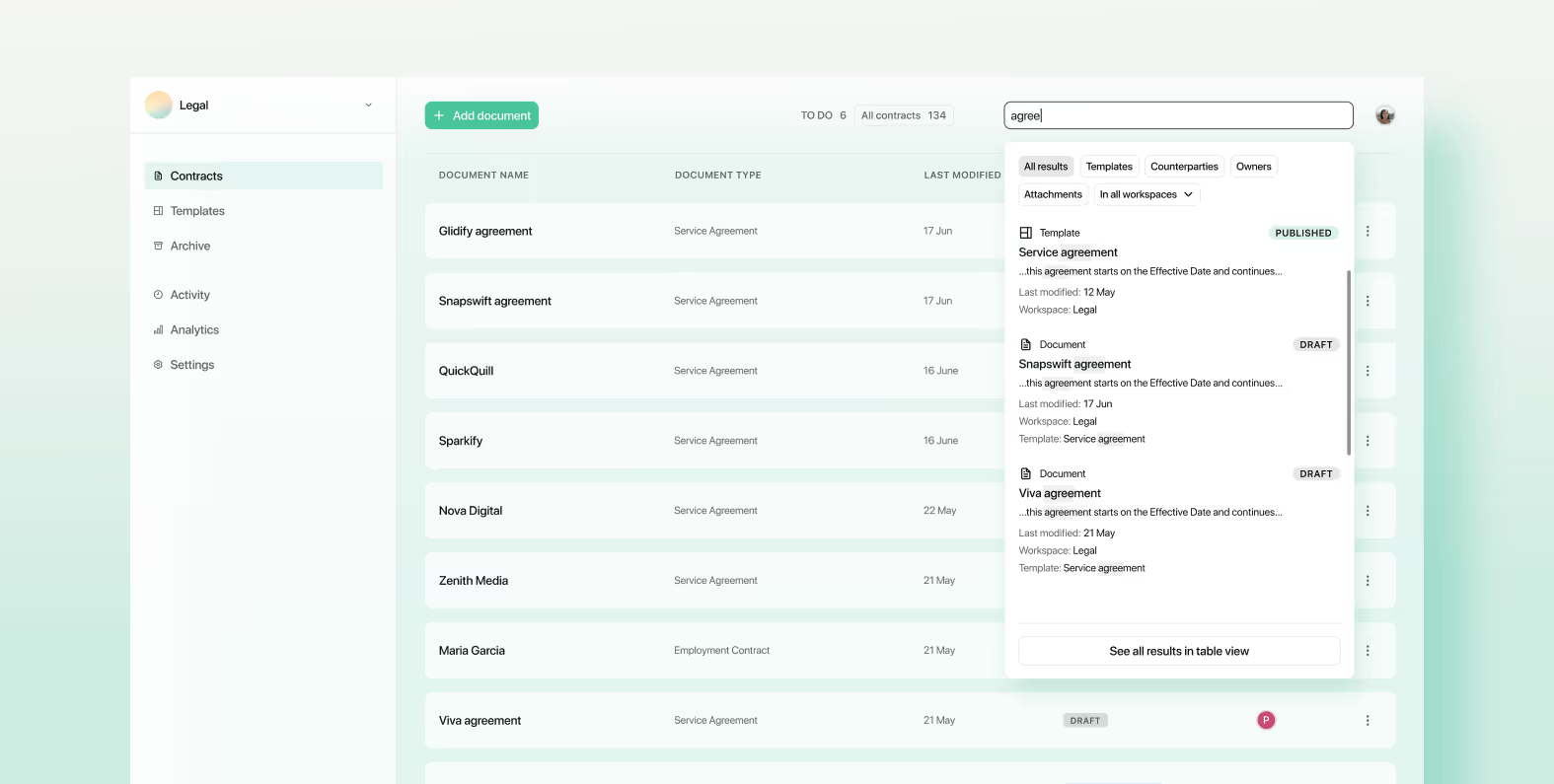

Finance teams need instant answers to contract questions. But if contracts are buried in folders or saved as PDFs, searching becomes painful.

In fact, it’s estimated that individuals spend up to two hours searching through a legal document for certain data points, terms or language. And with Fortune 1000 companies estimated to manage between 20,000 to 40,000 active contracts at a time, those hours stack up quickly.

That’s why a CLM that serves finance teams must offer:

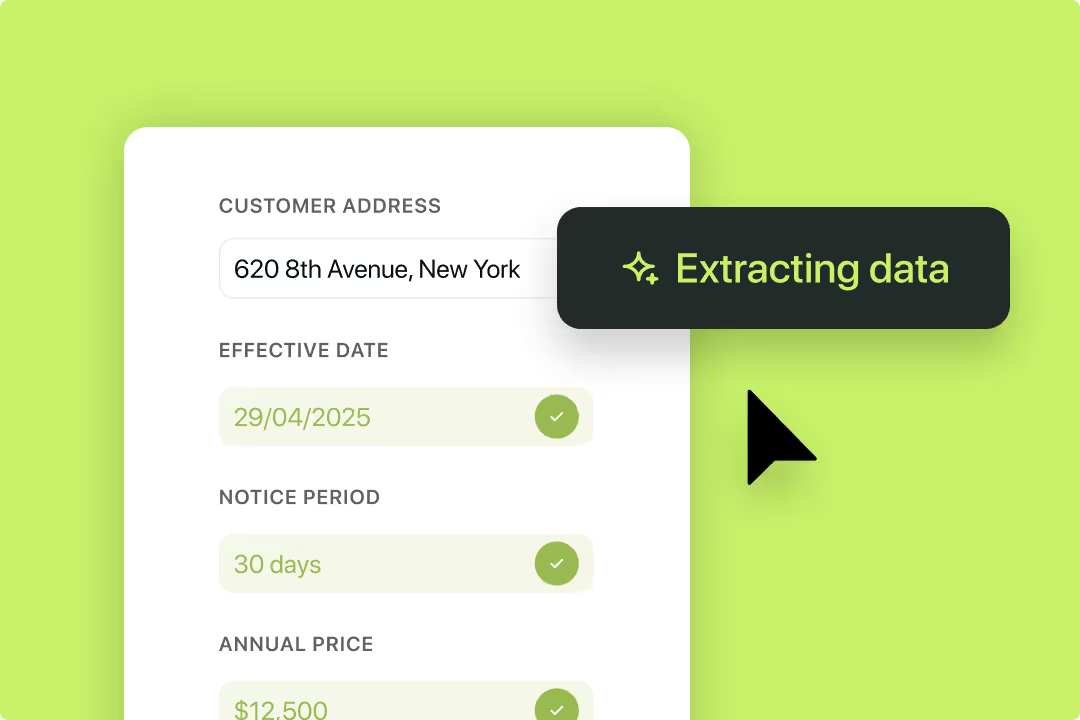

Juro’s contract repository is built on structured data — which gives finance insights that rival BI tools, without needing analysts to manually extract anything.

And with Juro’s AI Extract, finance teams don’t need to rely on manual data entry to track these contract milestones. The system automatically identifies renewal dates, notice periods, billing cycles and payment terms from uploaded contracts, transforming legacy PDFs into clean, structured data that can trigger reminders instantly.

Contracts always trigger financial activity — from invoicing and billing schedules to revenue recognition, renewal, and spend tracking.

If your CLM isn’t integrated with the tools that manage these processes, finance teams end up copying values across systems manually, which slows everything down and introduces avoidable errors.

Juro connects directly to platforms like Xero, QuickBooks, Salesforce, HubSpot, procurement tools and internal data warehouses, pushing structured contract data straight into the systems that need it.

This means no duplicate entry, cleaner billing and revenue records, and automated invoicing and forecasting workflows that actually work at scale.

For finance teams, the impact is simple: faster processes, fewer mistakes, and hours of manual reconciliation saved every month.

{{quote3}}

When finance leaders evaluate CLM platforms, these five questions usually reveal the right answer fast.

1. What data do we need from contracts to forecast accurately?

If your models rely on ARR, billing cycles, payment terms or renewal dates, the CLM must capture these fields as structured data — not as unsearchable text inside PDFs. Without this, forecasting accuracy will always depend on manual reconciliation.

2. How often do commercial teams produce non-standard terms?

If the answer is “more than we’d like,” you’ll need conditional workflows that automatically flag unusual discounts, payment schedules or commitments for finance review before they become a problem.

3. Where does contract data need to flow next?

Think about the systems that rely on contract values — CRM, billing, ERP, procurement, BI. A CLM should pass clean, structured data into all of them without adding another administrative layer.

4. How much manual work is happening today?

Estimate the hours your teams spend chasing renewals, extracting contract values, adjusting revenue schedules or correcting errors from manual drafting. Once you quantify the admin load, the ROI of automation becomes hard to ignore.

5. Can the CLM scale with us?

A growing business needs a CLM that can handle thousands of agreements, support multiple teams creating contracts at once, and enforce consistent commercial terms automatically — even as volume and complexity increase.

Finance teams choose Juro because it gives them the clarity and confidence they need to run a modern, data-driven organisation.

Instead of being a legal-only tool or a sales-only template engine, Juro gives every team a single, shared workspace for creating, approving, signing and tracking contracts.

Sales, procurement, HR, customer success and legal all work from the same platform, using the same processes, following the same commercial rules.

For finance, this is transformational. When every team generates agreements in one place, using the same workflows and the same structured data fields, finance finally gets a unified, accurate view of the company’s commitments — not five different versions scattered across drives and inboxes.

Juro becomes the central layer that connects commercial activity with financial insight, ensuring the numbers finance sees in forecasts and models are grounded in the contracts the business is actually signing.

The platform centralizes contracting for the whole business, giving finance the visibility, consistency and collaboration it needs to plan confidently and operate at scale. To learn more about Juro, fill in the form below.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.