Solutions

Customer Support

Resources

Every contract tells a story — of promises, pricing, and performance. But if you strip away the legal jargon, what really matters is one number: how much is this deal worth?

That number is your contract value — a metric that sits at the intersection of sales, finance, and legal. It captures not just how much revenue a single agreement brings in, but how it shapes your company’s growth, risk profile, and financial health.

This guide breaks down what contract value really means, how to calculate it properly, and why it’s so central to modern contract management.

Contract value — or Total Contract Value (TCV) — is the total revenue a business expects to earn from a contract over its full duration.

In simpler terms, it’s the sum of all payments (recurring and one-off) agreed in a contract. That might include:

Tracking contract value gives legal, finance, and commercial teams a clear picture of how much each agreement is really worth — and how that feeds into company growth. In fact, measuring and reporting on this metric is critical to modelling revenue and measuring sales efficiency across SaaS and service-based businesses.

At its simplest, Total Contract Value (TCV) is the total revenue you expect from a contract over its lifetime.

That includes all the recurring payments you’ll receive during the term — plus any one-off fees — minus discounts or credits that reduce what the customer actually pays.

But in reality, contracts are rarely that simple. Below, we’ll break down what to include, what to leave out, and how to handle common scenarios like discounts, renewals, and usage-based pricing.

tart by defining how long the customer is actually committed to pay you for.

Tip: In B2B SaaS, TCV is almost always calculated based on the committed term — not potential renewals or upgrades.

Multiply your Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR) by the contract length.

£1,000 MRR × 12 months = £12,000 (£1,000 × 6 months) + (£1,500 × 6 months) = £15,000Add any non-recurring fees, such as: implementation or onboarding costs, training or consultancy, hardware, setup, or installation charges. If your contract includes these, they should be counted in your total.

Next, factor in commercial adjustments:

This gives you a realistic view of what you’ll actually earn, not just the headline rate.

For consumption-based contracts (common in SaaS and telecoms):

£500 × 12 = £6,000.If you also expect regular overages, you can calculate an “expected TCV” scenario separately — but keep the committed figure for reporting.

Avoid double-counting by excluding:

Understanding contract value is one thing — managing it efficiently across hundreds of agreements is another.

That’s where Juro helps teams turn contract value into a live, actionable data point.

With Juro’s conditional logic, legal teams can set value-based rules into contract templates.

{{quote1}}

This keeps risk under control while allowing sales teams to move faster on routine contracts.

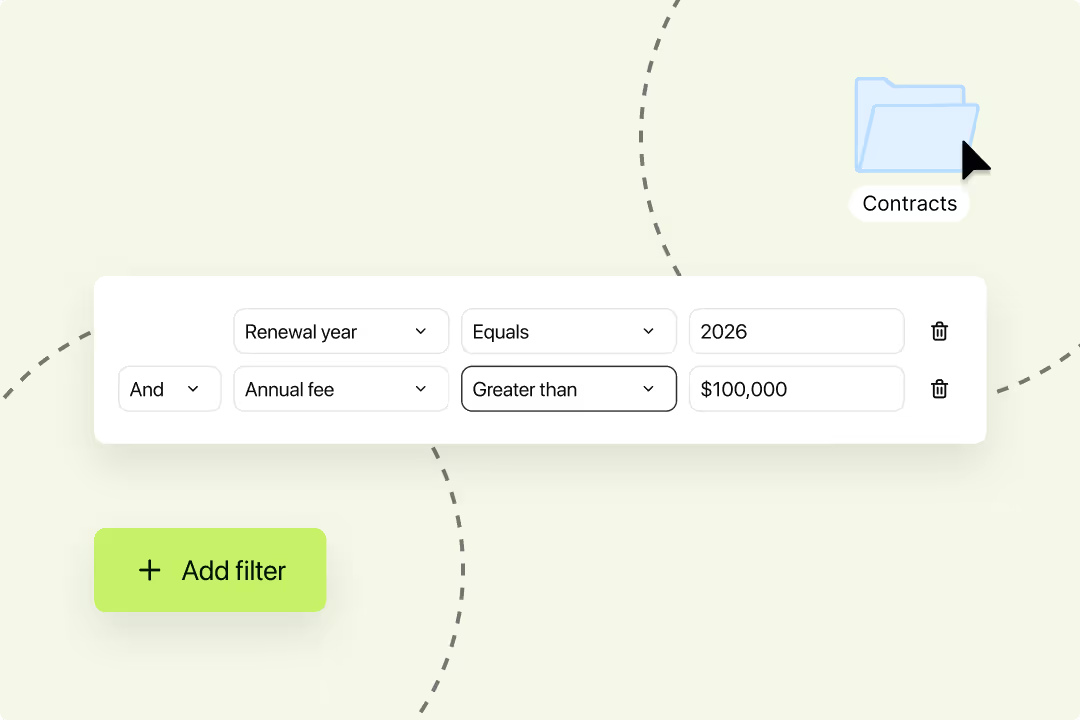

And these benefits continue into post-signature contract management, too. Every contract created in Juro is structured data — not a static document, so you can instantly filter contracts by value, customer, or status.

Juro's ChatGPT integration automates this data retrieval further, allowing you to ask questions around contract value to your contracts directly.

This functionality makes it easier than ever to track revenue exposure, prep for audits, or identify bottlenecks delaying high-value deals. When raising capital, going through due diligence, or running board reports, that visibility can save weeks of manual work.

Contracts hold a wealth of financial data, but few figures are more revealing than Total Contract Value (TCV).

Tracking TCV tells you how much revenue each agreement contributes, but it also gives visibility into growth, risk, and performance across your customer base. Here’s why it matters.

Knowing the total value of all active contracts gives finance teams a clear picture of future cash flow and revenue.

It’s how leaders assess whether growth is sustainable, budgets are realistic, and renewal pipelines are healthy. In fast-scaling SaaS or service businesses, TCV is the foundation for accurate revenue forecasting — not guesswork.

Contract data doesn’t just live in the past, it guides better deals in the future.

By comparing TCV across existing customers, legal and sales teams can see where they’ve discounted too heavily, where pricing held firm, and which terms deliver the most value. This context helps avoid value leakage and ensures you negotiate from a position of data, not instinct.

High-value contracts come with higher stakes: liability, delivery, and reputational risk all scale with the numbers.

Tracking contract value allows legal teams to flag large deals for extra scrutiny, while smaller, low-risk agreements can move faster through the workflow. This helps balance deal velocity with compliance.

TCV also reveals which customers or vendors drive the most value for your business.

If 20 per cent of your clients account for 80 per cent of revenue, you can tailor your retention, support, and expansion strategy accordingly. For leadership teams, it’s a clear way to prioritize relationships and allocate resources effectively.

When contract data lives in PDFs or Word docs, calculating TCV means digging through static files and contract management spreadsheets.

In Juro, contracts are built as structured data — meaning fields like MRR, contract term, discount, and setup fee can be tracked automatically.

That means:

So instead of guessing, you know exactly how much each contract is worth and how it contributes to your bottom line. Turn your contracts into live commercial data — book a demo to see how Juro makes tracking contract value effortless.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.