Solutions

Customer Support

Resources

Knowing exactly what you’ll be expected to pay for a good or service provides certainty for your finances and helps to stay in budget.

Fixed-price contracts provide this certainty and predictability, as you know what you’re expected to pay before you enter into a contract.

But what is a ‘fixed-price contract’, and how does it work? Let’s find out.

A fixed-price contract is a contractual agreement that outlines the terms of a project and sets the price for goods or services provided.

This means that the price of the project remains the same throughout the entire duration of the contract even if the cost of materials, amount of time stated, or any other external factor changes.

This is distinct from a cost-plus contract where costs are estimated within the contract, but the actual fee isn’t finalized until the project or obligations have been completed.

Fixed-price contracts can also be known as a:

Fixed-price contracts are simpler than cost-plus contracts as they provide clarity and certainty around pricing, while cost-plus contracts do not.

The main purpose of a fixed-price contract is to establish a clear and firm price for the delivery of goods and services. They’re designed to reduce uncertainty and simplify the contracting process, rather than complicating it with lots of variables.

This is important since the purpose of any contract is to provide clarity for parties and ensure that they can pursue a business relationship without facing any nasty surprises later down the line.

Due to their predictability, fixed-price contracts are one of the most popular types of business contracts. However, fixed-price contracts are best suited for transactions where a project’s scope can be clearly defined early on. Otherwise, you risk miscalculating the price of the work, and this can leave parties out of pocket.

To avoid this scenario, fixed-price contracts should only be used for projects where you can estimate the time and resources required to complete the job accurately. That’s why they tend to be used for smaller construction projects, rather than large ones with lots of variables.

However, not all fixed-price contracts are equal. There are a few different types of fixed-price contracts, each of which is designed to cater to different transactions. Let’s explore a couple of these now.

"Fixed-price contracts should only be used for projects where you can estimate the time and resources required to complete the job accurately"

As we just mentioned, fixed-price contracts come in many forms.

However, the three most common types of fixed-price contracts include:

Firm fixed-price contracts are used in situations where the buyer pays the seller a fixed amount, regardless of whether extra costs are incurred or more resources are required in the course of the transaction.

Let’s imagine you hire a contractor to build you a fence around your front garden. If the contract says that the fence will cost you $2000 regardless of how long it takes and how much the materials cost, this will be a firm-fixed-price contract.

A fixed-price incentive fee contract is a type of fixed-price contract whereby a seller is eligible for a bonus or ‘incentive’ if they deliver on the promises of a contract early and exceed certain expectations, like quality or delivery ahead of schedule.

Let’s take another look at the fencing work example. If the contract says that you will pay $2000 for the fence to be built by the end of the month, or $2,500 if it is built by the end of the week, this is a fixed-price incentive fee contract.

This is because you have offered a separate sum if the work is completed early, and this acts as an incentive.

A fixed-price with economic price adjustment contract is slightly more complex than the other two types.

It operates on the basis that a buyer pays the seller a fixed fee, but with some flexibility for price adjustment in certain situations. These situations include market fluctuations and other events that are out of the seller’s control.

Generally speaking, the buyer still promises to pay the seller a fixed-price. However, in this situation, the parties would have agreed on a few specific exceptions whereby they can adjust the pricing to reflect uncertainties in market conditions.

This type of fixed-price contract is only really used for long-term projects that span multiple years, not short-term and more immediate work.

We mentioned briefly at the beginning of this post that fixed-price contracts provide greater clarity for parties. But they certainly aren’t perfect. Like most types of contracts, fixed-price agreements have their pros and cons.

One significant advantage of fixed-price contracts is that they are more likely to be approved by senior stakeholders than cost-plus contracts. This is because the final fee is set in stone, so there’s no risk of the price increasing indefinitely.

This is an attractive prospect for stakeholders as it means they can predict pricing more accurately and steer clear of unanticipated fees.

As we’ve mentioned throughout this post, fixed-price contracts are often praised due to their predictability. Entering into a fixed-price contract often gives buyers peace of mind since they are aware of what they will owe the seller early on, and this enables them to budget accordingly.

This predictability can also benefit sellers, too. This is because it enables them to complete the project according to a fixed budget.

Fixed-price contracts are also simple contracts, which makes them easier to draft. The scope of a fixed-price contract is often far clearer than other contracts, and the payment terms are also more straightforward.

Since fixed-price contracts don’t allow for pricing amendments, it’s common for sellers to inflate their prices to account for the risk of work taking longer than expected, or materials costing more than anticipated. This means the overall price may be higher than with cost-plus contracts in some cases.

Another obvious disadvantage of fixed-price contracts is that if any unforeseen challenges or costs occur throughout the project, the seller will be responsible for forking out for these.

This makes fixed-price contracts slightly less appealing for sellers, as they can be risky when used for projects that are difficult to estimate the value of.

Another drawback of fixed-price contracts is that they aren’t flexible. This means that if the scope of the project changes over time, a fixed-price contract won’t be able to reflect these changes. Other types of procurement contracts, like time and materials contracts and cost-reimbursable contracts, provide much more flexibility.

Like most contracts, a fixed-price contract should include the following things:

It’s also worth remembering that a fixed-price contract won’t be legally binding unless it has all of the core contractual requirements.

Fixed-price contracts are like any other contract in that they need to be managed properly to reduce risk and avoid legal trouble.

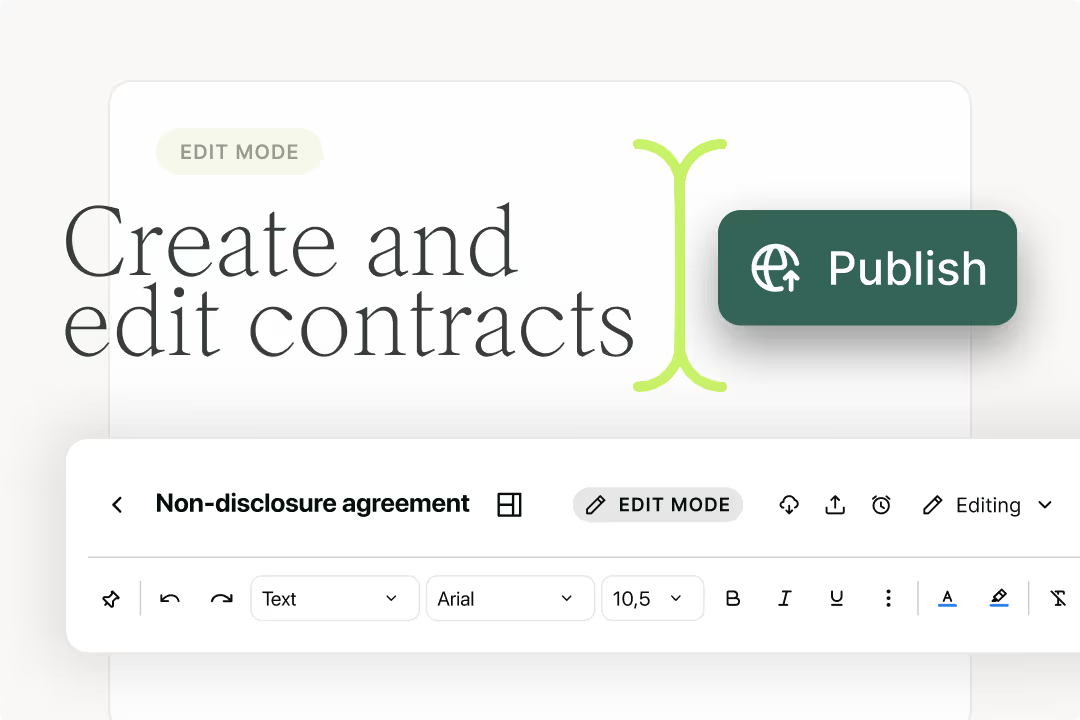

Fortunately, since fixed-price contracts are often simple and standardized contracts, they’re easy to manage using a tool like Juro - here’s how.

Using a contract automation tool like Juro, legal teams can create automated contract templates for commercial teams to self-serve with.

These templates can be populated within seconds using either a natural language Q&A workflow, or by pulling data directly into the contract smartfields from another business system like Salesforce or Pipedrive.

This makes it quick and easy to generate fixed-price contracts. Plus, it eliminates the need for lean legal teams to spend their time on low-value work like contract authoring for standard agreements.

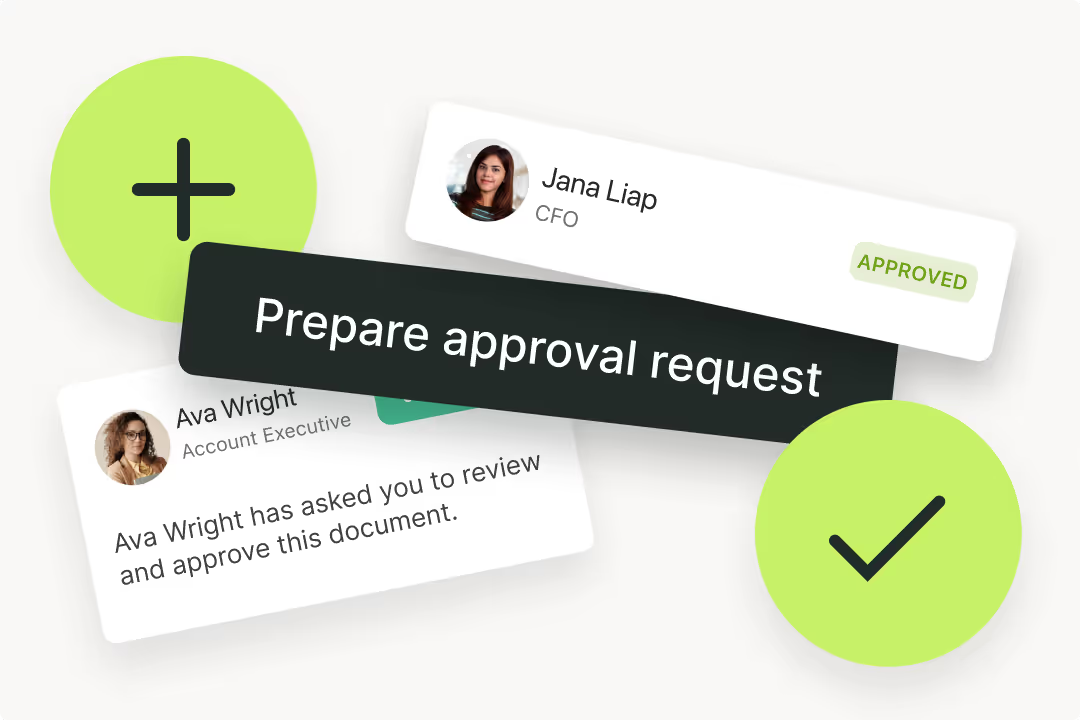

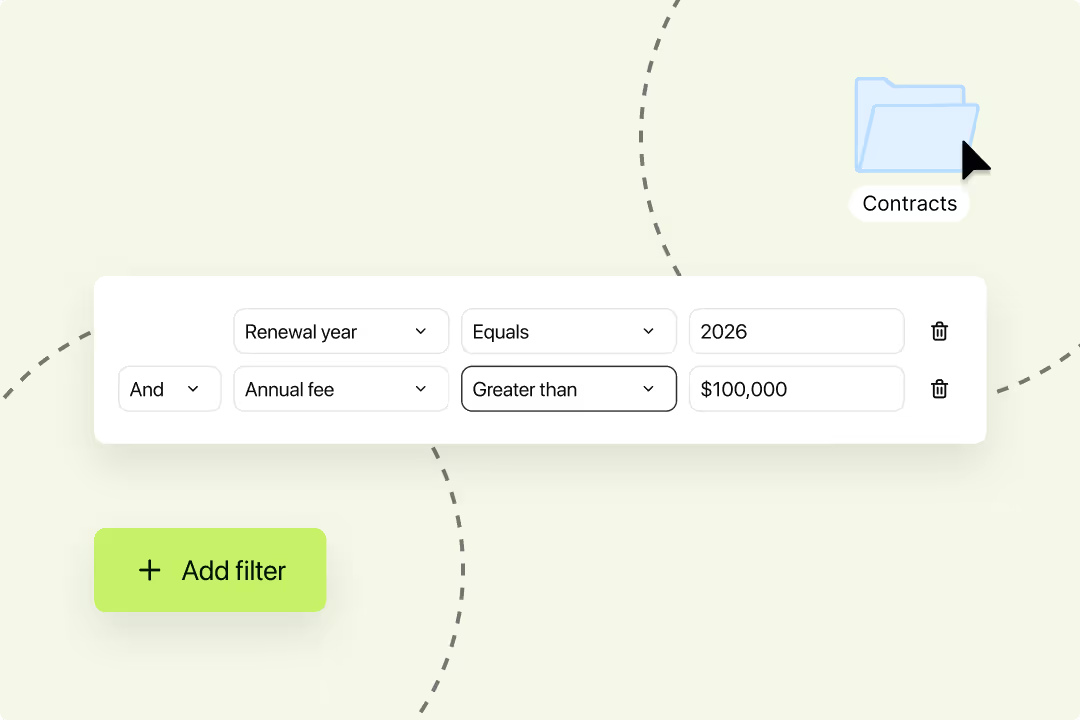

For higher-value fixed-price contracts, you can even use Juro to establish contract approval workflows. These approval workflows can be set up manually for each individual contract, or they can be automated using conditional logic rules.

In other words, if you decide that contracts with a value over a certain threshold must receive approval from certain stakeholders, this can be built in at template level. This means that if a fixed-price contract is created using this template, and it has a value over that threshold, the contract will automatically require approval before it can progress to the next stage of the contract lifecycle.

This helps to ensure that your fixed-price contracts are watertight, and it enables you to reduce contract risk.

Despite being relatively straightforward, it’s rare for fixed-price contracts to escape the contract negotiation phase.

Within a manual contract workflow, this would often mean fixed-price contracts move back and forth between Word, email, and shared drives. This process is repeated again and again until all parties have agreed on the terms included.

Negotiating fixed-price contracts in this way is time-consuming and tends to create friction.

Fortunately, it’s far smoother when you use a contract management system instead. For example, Juro users can negotiate contracts without ever needing to leave the platform.

They simply share the contract with the counterparties and add redlines directly into the dynamic contract version. They can even tag parties in comments, discuss contentious clauses using threads, and they can track all activity using a contract audit trail.

It’s 2026 and wet ink signatures are no longer the best and most efficient way to sign fixed-price contracts. Instead, businesses are moving towards a digitized alternative: electronic signatures.

Juro’s eSignature functionality empowers legal and commercial teams to sign contracts in the same platform they created them. Not only that, but Juro’s eSigning feature also works on a wide range of devices, enabling you to sign contracts on the move.

This is great for those competitive fixed-price contracts that need to be closed quickly.

It’s worth noting that managing your fixed-price contracts doesn’t end once they’re signed. In fact, they’ve only just started. Next, you need to monitor your contractual obligations and ensure contract compliance.

Yes, it sounds obvious. But you’d be surprised how many businesses find themselves in hot water because they buried their contracts in shared drives (or worse, physical filing cabinets) and never looked at them again.

For scaling businesses, storing contracts effectively is essential to staying on top of contractual obligations. Fortunately, Juro enables users to monitor their contracts with ease.

Not only can Juro users search through masses of contracts for certain words, phrases, numbers and characters within seconds, but they can also capture and analyze contract data in Juro’s analytics dashboard, too.

Juro’s AI-enabled contract automation platform enables all teams to streamline the creation, execution and management of routine contracts at scale.

To find out more about how Juro can make managing fixed-price contracts frictionless, fill in the form below.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.