Solutions

Customer Support

Resources

As your business scales and your contract volumes increase, managing contract obligations can be a challenge. Without a robust system of record for contracts, key dates can be missed and deliverables can be forgotten, occasionally resulting in a breach of contract.

Breaches of contract can cause relationship breakdown between parties, but they can also come at a significant financial cost. This deep-dive explains exactly what a breach of contract is, why they’re happening and how implementing a contract management solution can help your business to prevent them.

A breach of contract occurs when one party fails to fulfill their obligations under a legally binding agreement without a valid legal excuse.

This breach can take various forms, such as not performing a duty on time, not performing in accordance with the terms agreed upon, or not performing at all. This means it covers everything from late delivery of certain goods or services to missed payments.

Firstly, the contract must have existed and been legally binding between the parties. If there wasn’t a contract in the first place, then it is impossible for there to have been a breach.

Next, you’ll need to be able to prove that specific terms within a contract have been breached. For this, you’ll need to be able to demonstrate, using evidence, that certain obligations existed under the contract and that these obligations were either not performed or have not been delivered to a satisfactory standard.

A breach of contract is caused by a contracting party’s reluctance or inability to fulfill the terms they originally agreed to within the contract. This results in certain contractual obligations going unmet, and the promises made within a contract being undermined.

Unfortunately, it’s not rare for breaches of a contract to happen. They can happen for a number of reasons:

One example is where a contracted supplier has failed to deliver certain goods to a business, which can result in the buyer being unable to fulfill the contractual obligations they owe separately to another business.

This is common in supplier contracts and procurement contracts. There could even be other external circumstances that make it challenging to deliver certain goods and services in a timely fashion, like outages or technical difficulties.

Alternatively, there could be a misunderstanding between different departments within a business about what the obligations actually are.

Whilst most commercial agreements are drafted and agreed by in-house legal teams, it’s often the sales, customer success, and business operations teams that are responsible for performing certain tasks under the contract.

If these aren’t communicated effectively between departments, these duties can be missed, resulting in a breach of contract.

It’s also possible that contract obligations just haven’t been tracked effectively by a business, meaning that dates to pay invoices, deliver onboarding and arrange certain goods or services get missed altogether.

This is common in companies without a single system of record for contracts, as important contract data gets trapped in static files and so isn’t tracked.

The risk of this happening only increases in scaling companies that manage fast-growing contract volumes. The more contracts you manage, the more obligations you have to meet, and the harder it is to keep a firm grasp on these.

That’s why modern businesses like Trustpilot, Deliveroo, Remote, and TheRealReal use Juro’s contract management software to regain control over contracts and the obligations within them.

If you’re a fast-growth business seeking a more secure and efficient way to manage your contracts and compliance, hit the button below to find out more.

Also known as a partial or immaterial breach of contract, a minor breach of contract is used to describe situations where the main deliverables of a contract have mostly been achieved, but not to the specific standard outlined within the contract.

This might occur when a good or service has been substituted with an alternative, for example. It can also be used to describe when something has been slightly delivered later than outlined within the contract terms.

A company hires a catering service for a corporate event, specifying that a particular brand of sparkling water must be served. The catering service delivers the correct quantity of drinks but substitutes the specified brand with a different one of similar quality. The event goes smoothly, but the company is dissatisfied because the contract terms were not fully met. While this is a breach, it is minor because the overall service was still provided.

Since most minor contract breaches won’t substantially change the output of a contract, parties will usually have to show evidence that the breach has been detrimental to them in some way in order to seek certain remedies. This typically means the business will have to show that the breach resulted in a financial loss of some sort.

A material breach of contract occurs when terms within the contract are breached and this breach results in a substantially different result to what was originally specified in the contract. Usually, this means that they have received significantly less value from the contract than they were promised.

A good example of this is where a party has failed to perform their obligations within a contract altogether, or they fail to deliver these on time and it has had knock-on implications for other business transactions.

A construction company is contracted to build an office complex by a specific deadline. However, the company fails to complete the project on time, causing the client to lose out on a significant leasing opportunity. This delay also disrupts other business plans, leading to substantial financial losses. The breach is material because the failure to deliver on time significantly impacts the contract's intended outcome, and the client can seek damages for the losses incurred.

Whether the breach is perceived as material or not will often be left to the interpretation of the courts, and they will consider the following things:

If a party can prove that a material breach of contract has occurred, they can typically sue the counterparty for any direct and indirect losses they suffered as a result of this breach.

An anticipatory breach of contract occurs when the breach hasn’t actually happened yet but one of the parties expresses their intention to breach the contract’s terms.

Usually, an anticipatory breach of contract occurs when a breaching party notifies the counterparty about their decision not to fulfill the obligations. This decision can be intentional or because they are physically unable to. But it can also occur when one of the parties’ actions suggests that they won’t fulfill their obligations, without them explicitly voicing this intention.

A publishing company is under contract to deliver a manuscript by a set deadline. A month before the deadline, the author informs the publisher that they will not be able to complete the manuscript on time due to unforeseen personal circumstances. This anticipatory breach allows the publisher to seek alternative arrangements, such as hiring a new author or negotiating compensation before the actual breach occurs.

It’s important to note that an anticipatory breach of contract turns into an actual breach once the date certain obligations were due to be performed has passed.

An actual breach of contract is used to describe the failure to perform certain contractual obligations after the date they were due, or failure to perform them to a sufficient standard by this date.

A technology company agrees to deliver and install a new software system by January 1st. However, the company fails to install the system until March, well after the deadline, causing significant disruptions to the client’s business operations. This failure to meet the deadline constitutes an actual breach of contract. Depending on the impact, the client may seek remedies ranging from financial compensation to contract termination.

Actual breaches of a contract can be either material or minor, and there are usually an array of remedies available to the innocent party depending on the consequence of the breach for their business.

The most severe type of contract breach is a repudiatory breach of contract. This occurs when the breach goes to ‘the root of the contract’ and fundamentally undermines the purpose and performance of the contract.

A supplier is contracted to provide custom machinery for a manufacturing plant, which is critical for the plant's operations. Upon delivery, it is discovered that the machinery is entirely different from what was specified in the contract, rendering it useless for the plant’s needs. This fundamental failure to deliver the correct product undermines the entire contract. The manufacturing plant can treat this as a repudiatory breach, terminate the contract, and seek damages for any losses incurred due to the breach.

Usually, a repudiatory breach of contract will result in the breakdown of a contract in its entirety, unlike a minor breach of contract. However, that doesn’t necessarily mean that parties will be entitled to terminate the contract in the event of a repudiatory breach. The parties may choose to affirm the existing contract instead.

The specific consequences of a breach of contract will depend on a few factors:

Understanding these consequences helps parties to a contract evaluate their options and determine the best course of action when faced with a breach.

The consequences of a breach of contract often lead to feelings of frustration and inconvenience for all parties involved, regardless of the breach's severity. However, the specific outcomes depend on the nature of the contract, the seriousness of the breach, and the terms agreed upon by the parties.

When drafting a contract, parties typically outline the potential consequences of a breach within the contract itself. For instance, businesses might negotiate penalty charges for late payments or include provisions for early termination if certain obligations are not met. These predefined consequences help manage expectations and reduce disputes if a breach occurs.

Beyond what is specified in the contract, there is a range of remedies available to the innocent party, which are influenced by the severity of the breach. These remedies include:

So what can you do to prevent your business from ending up in a similar position? There are a few things you can do to ensure contract compliance. Let’s explore some top tips for preventing a breach of contract now.

Firstly, you should ensure that your contracts are robust. This means ensuring that they cover all of the terms and conditions necessary to protect your business from unexpectedly breaching the contract.

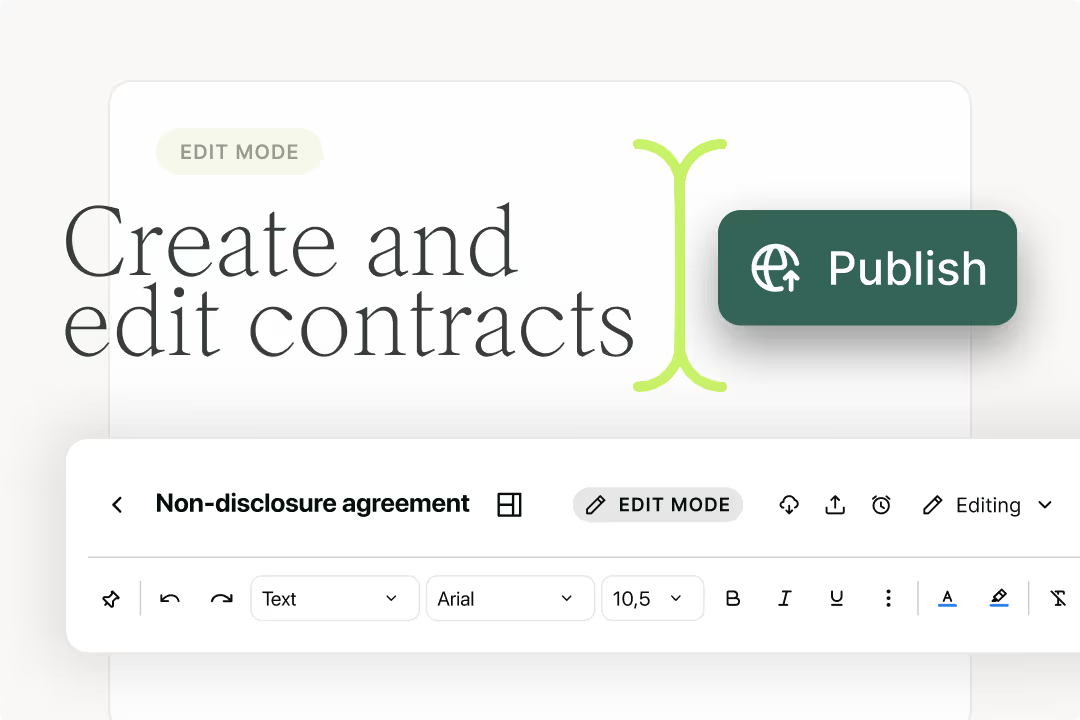

This can be challenging in businesses where contracts are drafted freely in Word by commercial teams using static contract templates that are updated on an ad-hoc basis.

Without sufficient oversight from legal, these contracts can omit important exclusion or limitation clauses, use incorrect contract terminology and compromise on certain positions to get over the line.

Businesses can avoid this by setting up dynamic automated contract templates instead. These can be used by commercial teams when self-serving on contracts, ensuring that the terms that end up in business contracts are pre-defined and approved by in-house legal teams.

Another way businesses can avoid a breach of contract is to ensure that each department is familiar with their specific responsibilities under a contract. If they aren’t, these obligations will go unmet.

The simplest way to do this is to ensure that all commercial teams have access to relevant contracts. When contracts are scattered across email and shared drives, it can be difficult for sales, HR, and finance teams to find and view these.

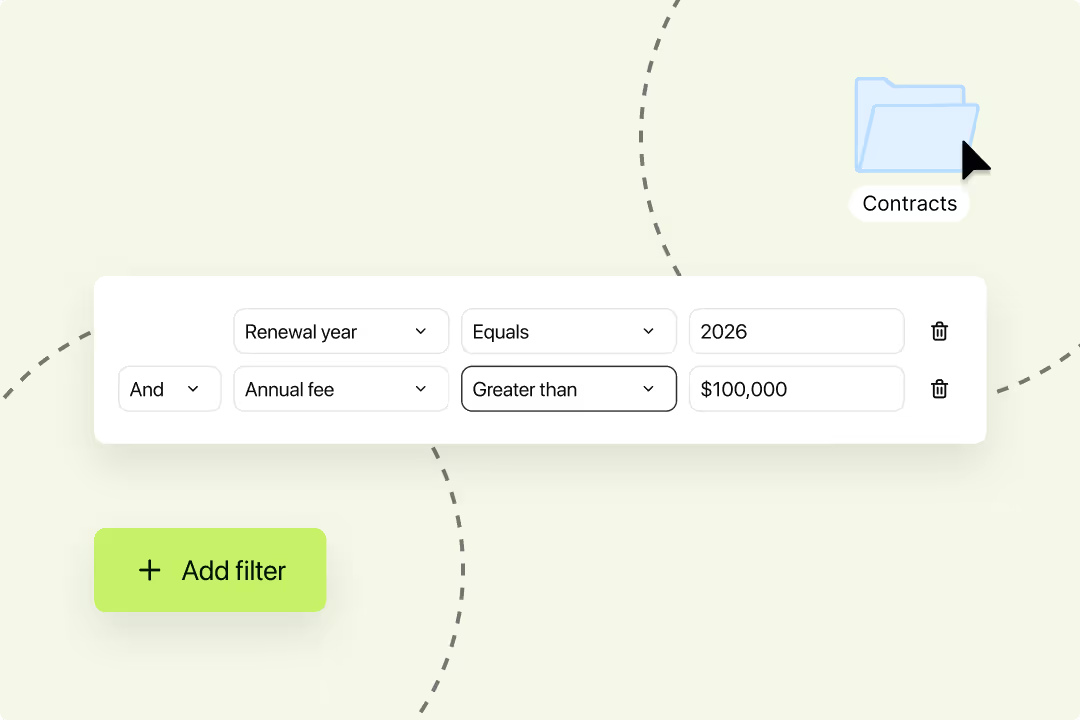

Finding a reliable way to capture and track important data points from your contracts is another effective way to keep on top of your contractual obligations. This process will make it easier to identify the effective date of a contract, contract renewal dates, contract values and other information that establishes which responsibilities need to be managed and when.

This information can then be collated into an excel spreadsheet or a contract dashboard for full visibility of upcoming deadlines.

Even better, if you use a contract tool like Juro, you can integrate the software with other project management tools like Monday.com, Greenhouse or Jira to trigger different tasks and actions based on this contract data.

It’s also a good idea to set reminders for different contract obligations. These notifications can be set throughout the duration of a contract to ensure specific deadlines are met for payment, delivery and other commitments made within the agreement.

These key contract milestones could be tracked manually, with the legal team issuing alerts when certain deliverables are due. Alternatively, you could automate the entire process and free up your legal team’s time to focus on higher-value tasks.

By adopting a contract automation solution like Juro, you can set contract reminders that auto-alert your team well in advance of upcoming deadlines. This means there’s no excuse for missing important dates and breaching your existing contracts.

If you’re finding it difficult to manage your contracts as you scale, and you’re looking for a more efficient way to track your contract obligations, why not try Juro?

Instead of switching between different tools with no visibility or control over upcoming contract deadlines, Juro helps visionary legal counsel and the teams they enable to agree and manage contracts obligations in one unified workspace.

Want to find out more? Fill out the form below to speak to one of our experts.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse varius enim in eros elementum tristique. Duis cursus, mi quis viverra ornare, eros dolor interdum nulla, ut commodo diam libero vitae erat. Aenean faucibus nibh et justo cursus id rutrum lorem imperdiet. Nunc ut sem vitae risus tristique posuere.